Cash, in the form of physical banknotes and coins, is still used in nearly every country globally. However, the world is seeing a clear trend of declining cash usage. Digital payment methods are growing fast, causing cash transactions to drop by around 1 to 2 percentage points annually since 2015. Despite this decline, cash remains vital for many. It offers privacy, is universally accepted, and is often the primary method for people without bank accounts. In some nations, cash dominates daily life. For instance, Myanmar leads the world, with approximately 98% of daily transactions done in cash. In this article, we'll look at the countries that still rely most on money and explore the reasons behind this reliance.

List of Countries with the Highest Share of Daily Transactions in Cash

According to data provided by Forex.se, here's the list of the countries that utilise the most cash in the world:

| Rank | Country | ISO Code | Share of daily transactions in cash |

| 1 | Myanmar | MMR | 98% |

| 2 | Ethiopia | ETH | 95% |

| 3 | The Gambia | GMB | 95% |

| 4 | Albania | ALB | 90% |

| 5 | Cambodia | KHM | 90% |

| 6 | Laos | LAO | 90% |

| 7 | Lebanon | LBN | 90% |

| 8 | Nepal | NPL | 90% |

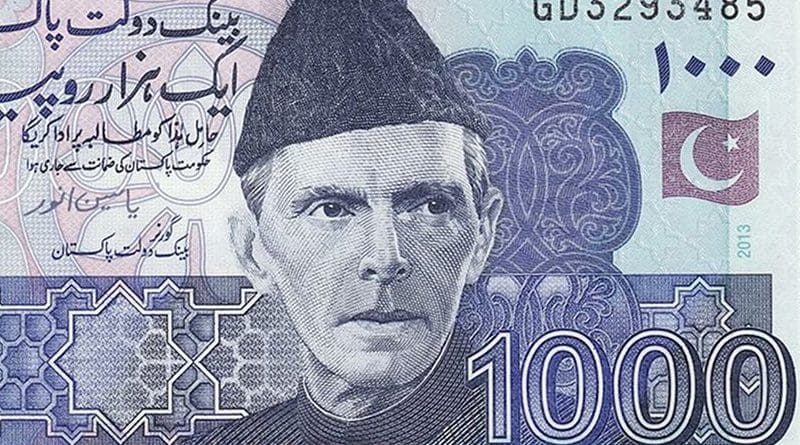

| 9 | Pakistan | PAK | 90% |

| 10 | Iraq | IRQ | 85% |

| 11 | Iran | IRN | 85% |

| 12 | Cuba | CUB | 85% |

| 13 | Mongolia | MNG | 85% |

| 14 | Egypte | EGY | 80% |

| 15 | Fiji | FJI | 80% |

| 16 | Gabon | GAB | 80% |

| 17 | Jamaica | JAM | 80% |

| 18 | Jordan | JOR | 80% |

| 19 | Mexico | MX | 80% |

| 20 | Moldavië | MDA | 80% |

| 21 | Sri Lanka | LKA | 80% |

| 22 | Tanzania | TZA | 75% |

| 23 | Trinidad en Tobago | TTO | 75% |

| 24 | Argentinië | ARG | 70% |

| 25 | Colombia | COL | 70% |

| 26 | Haiti | HTI | 70% |

| 27 | India | IND | 70% |

| 28 | Indonesia | IDN | 70% |

| 29 | Madagascar | MDG | 70% |

| 30 | The Maldives | MDV | 70% |

1. Myanmar (98%)

Myanmar ranks first globally, with 98% of daily transactions still conducted in cash. This extreme reliance stems from a severely limited banking infrastructure. Outside of main cities, most citizens are unbanked and lack access to digital payment systems. Decades of economic instability and a strong public distrust of formal banks also encourage cash hoarding.

2. Ethiopia (95%)

Ethiopia is nearly as cash-reliant, with 95% of daily transactions in cash. A key reason is the low rate of financial inclusion. Many citizens, especially in rural areas, do not have bank accounts or know how to use digital tools. The government has tried to limit cash withdrawals to fight corruption and illegal trade, but the economy remains intensely cash-intensive.

3. The Gambia (95%)

The Gambia also sees 95% of transactions conducted in cash. Limited access to banking and internet services outside the capital makes digital payments impractical for most people. Remittances, money sent home from workers abroad, often use cash pickup services because recipients lack bank accounts.

4. Albania (90%)

In Albania, 90% of daily transactions are in cash. Like other high-income countries, Albania has a large informal economy, where people use money to avoid taxes. The banking system has not fully modernised. Many small businesses and local markets rely only on physical currency.

5. Cambodia (90%)

Cambodia's daily cash use stands at 90%. While digital payments are growing in major urban centres, rural communities still transact almost entirely with cash. Access to banks and modern payment infrastructure is scarce in these areas. For many citizens, cash is the only readily available and trusted means of payment.

6. Laos (90%)

Laos, too, registers 90% of daily transactions in cash. Banking penetration is very low outside of the main cities. Digital infrastructure, including the internet and mobile networks, is underdeveloped in many parts of the country. This lack of access and development ensures that cash remains the default and most convenient method for almost all commerce.

7. Lebanon (90%)

Lebanon's high cash usage of 90% is mainly due to a severe economic and banking crisis. Years of financial instability have caused a massive loss of public trust in banks. Citizens often cannot access their savings, leading people to keep and use physical currency for daily needs.

8. Nepal (90%)

Nepal uses cash for 90% of its daily transactions. The country has a significant proportion of its population living in remote and rural regions. These areas have poor connectivity and virtually no access to formal banks or digital payment terminals.

9. Pakistan (90%)

In Pakistan, 90% of daily transactions are done in cash. There is a high rate of financial exclusion, meaning many adults lack bank accounts. Like others on this list, many in the informal sector prefer cash to avoid taxes.

10. Iraq (85%)

In Iraq, 85% of daily transactions are cash-based. This is primarily driven by a profound crisis of public confidence in the banking system due to past instability and corruption. People often hoard cash at home rather than deposit it in a bank.

27. India (70%)

India ranks below the top 10, with about 70% of daily transactions conducted in cash. Despite this high figure, India is a global leader in digital payments due to the government-backed Unified Payments Interface (UPI). UPI has enabled many transactions to go online rapidly.

Comments

All Comments (0)

Join the conversation